The information set forth on this website has been obtained or derived from sources believed by Newfound Research LLC (“Newfound”) to be reliable. However, Newfound does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does Newfound recommend that the information serve as the basis of any investment decision.

The information on this website is made available on an “as is,” without representation or warranty basis. The information herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. You should consult your investment adviser, tax, legal, accounting or other advisors about the matters discussed herein. These materials represent an assessment of the market environment at specific points in time and are intended neither to be a guarantee of future events nor as a primary basis for investment decisions.

Newfound Research makes no guarantee as to the accuracy, timeliness, completeness, or fitness for any particular purpose of or for any index values, either historical or back-tested. Nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. The model performance is not based on live results produced by an investor’s investment and trading, and fees, expenses, transaction costs, commissions, penalties or taxes have not been netted from the gross performance results except as is otherwise described. The performance results include reinvestment of dividends, capital gains and other earnings.

This information has been provided solely for informational purposes and does not constitute a current or past recommendation or an offer or solicitation of an offer, or any advice or recommendation, to purchase any securities or other financial instruments, and may not be construed as such. This information should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

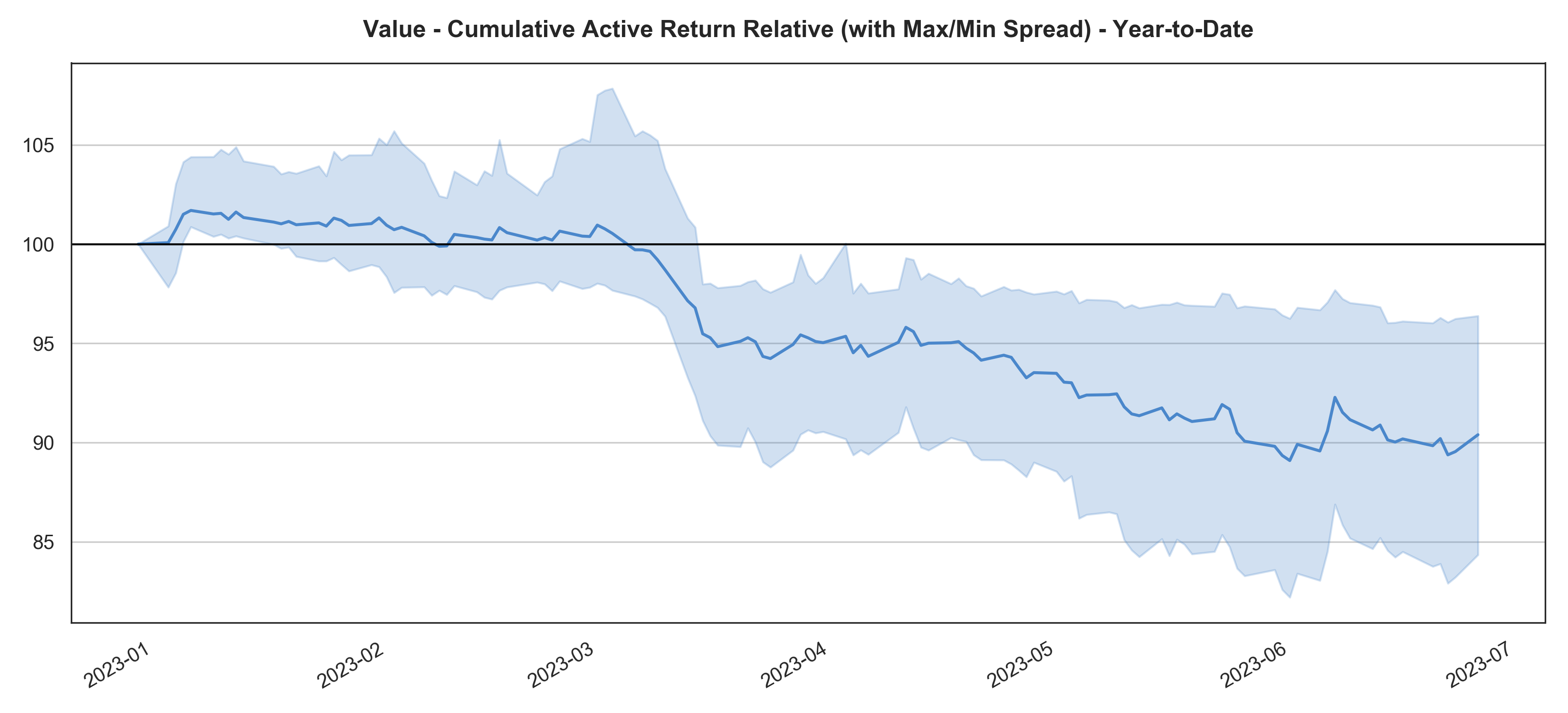

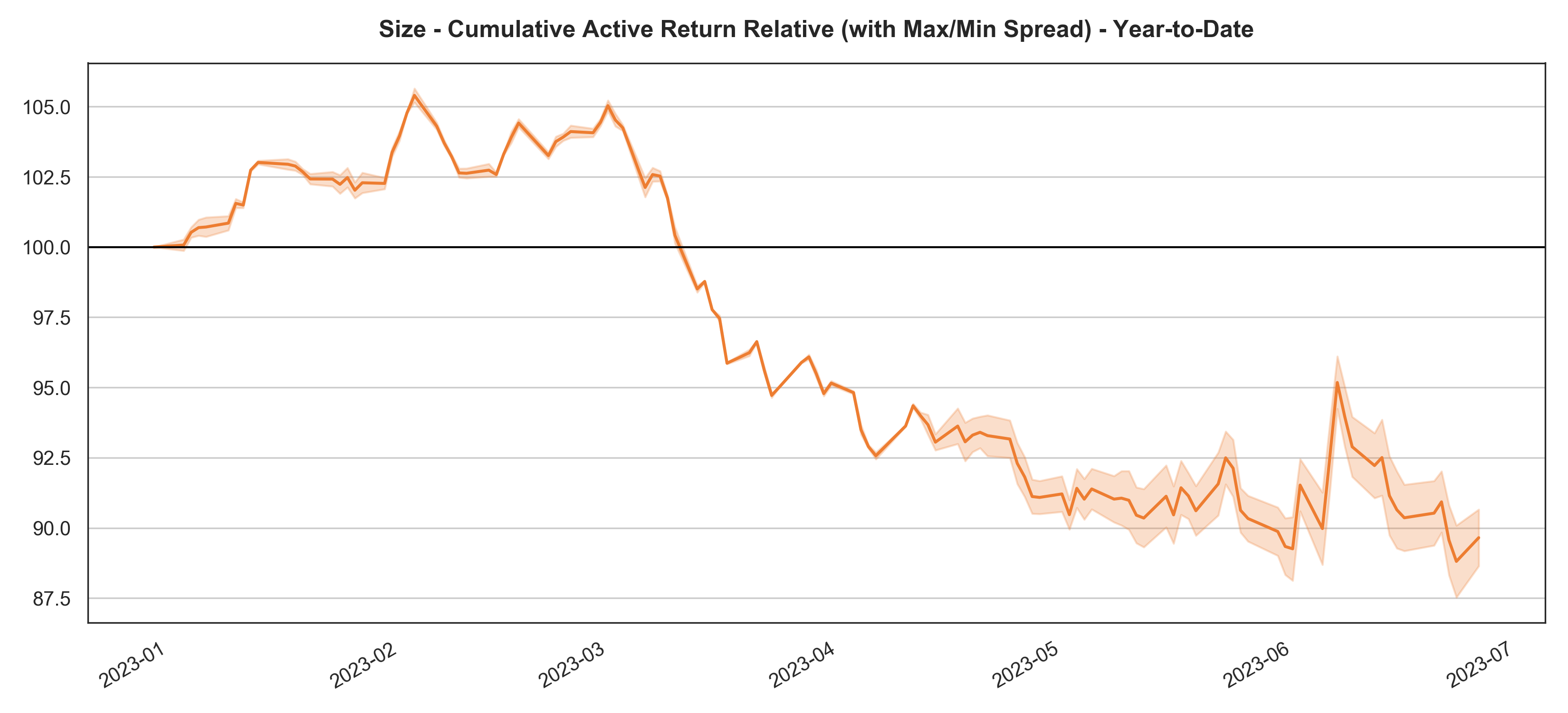

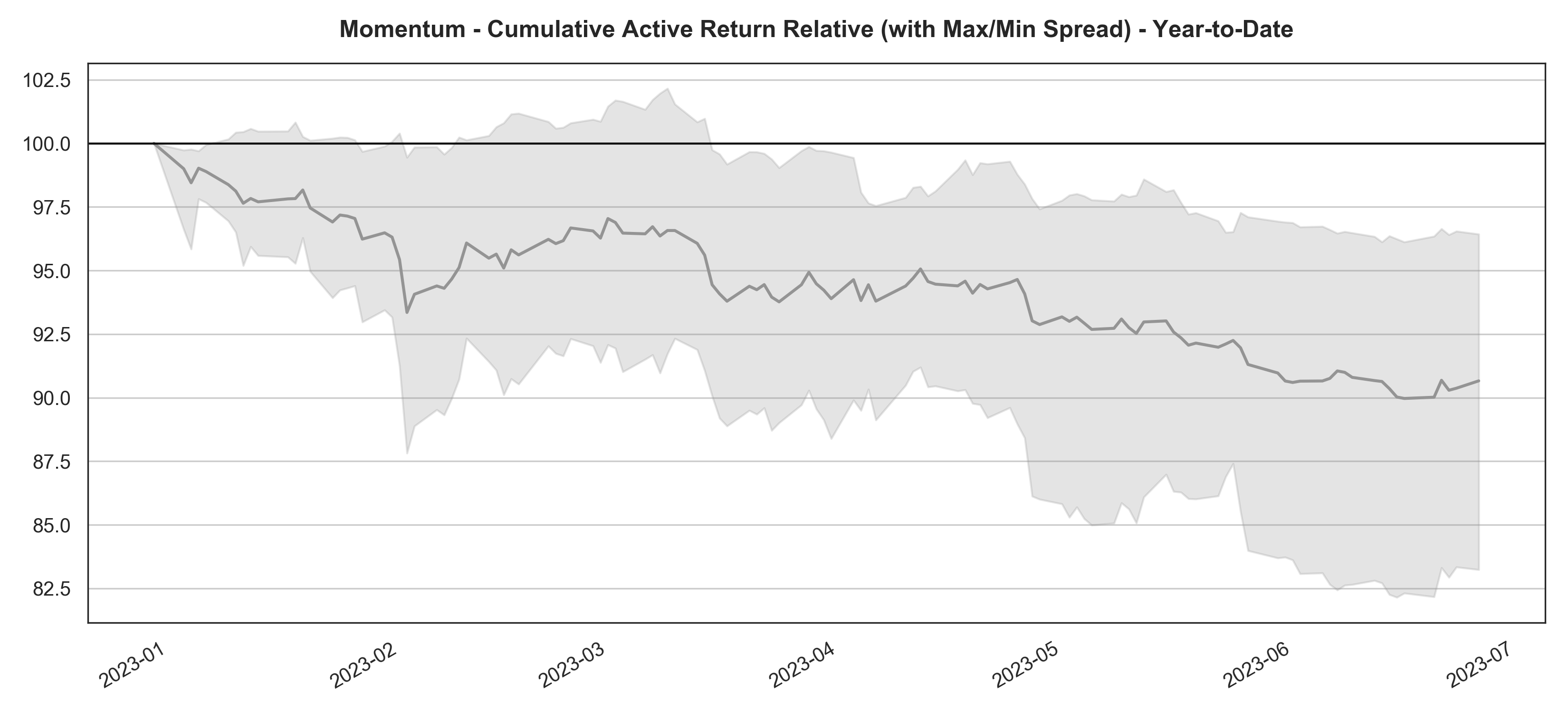

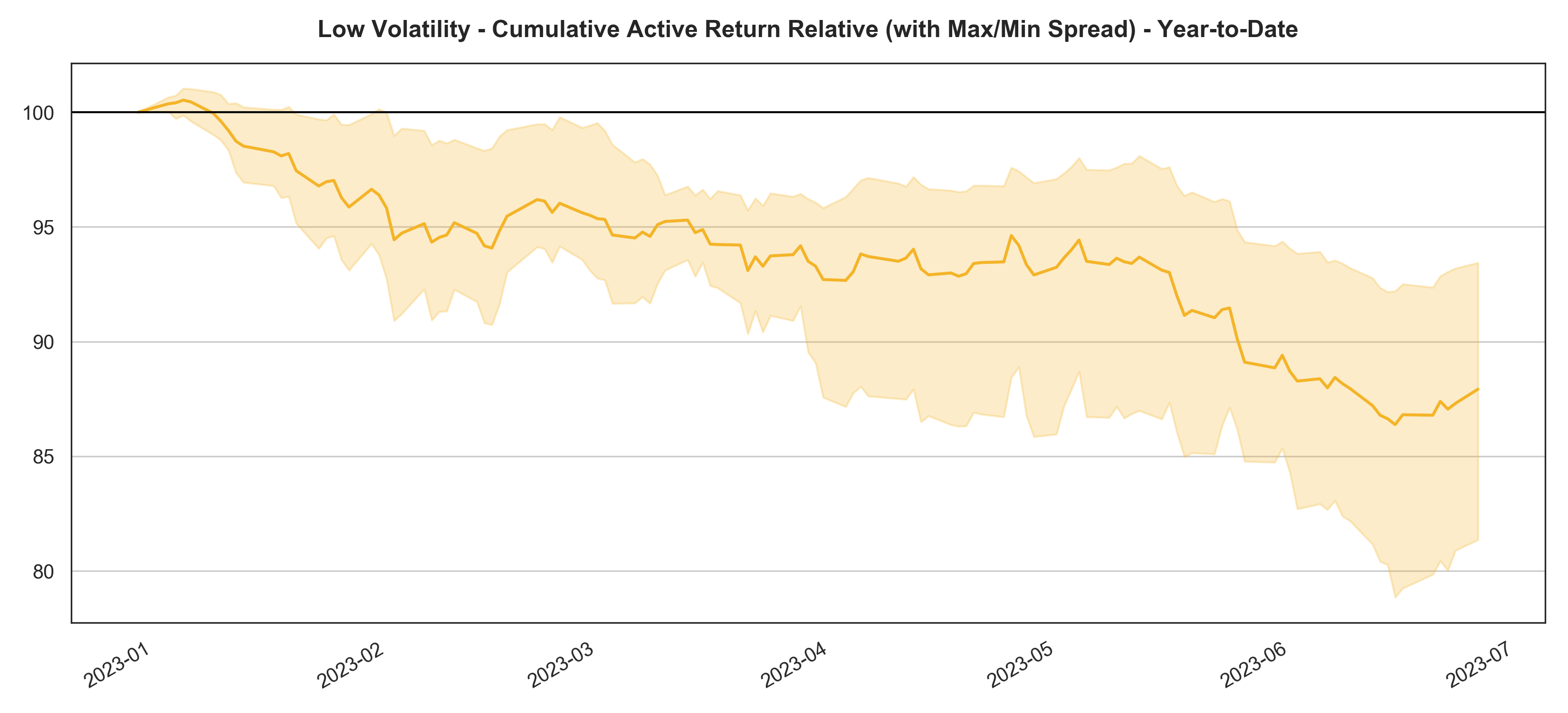

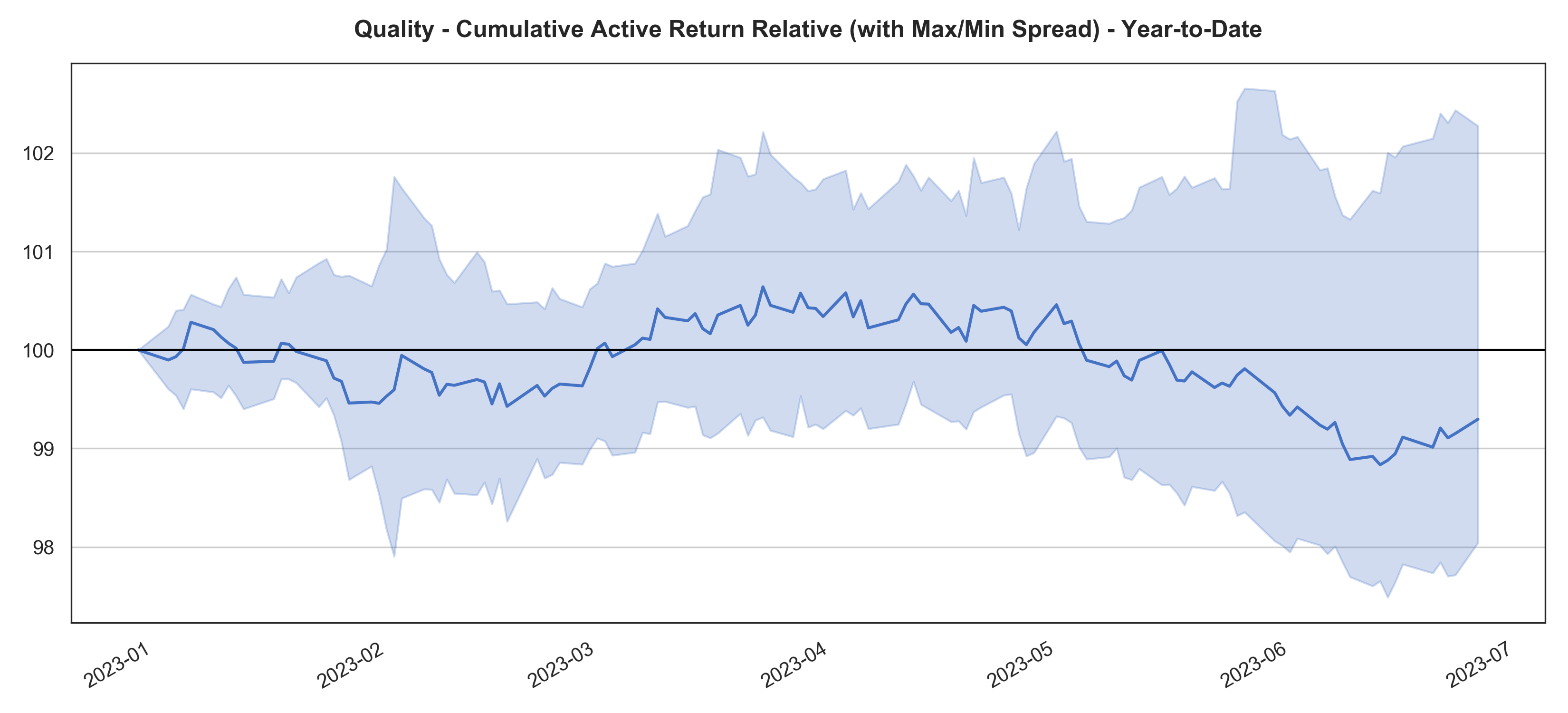

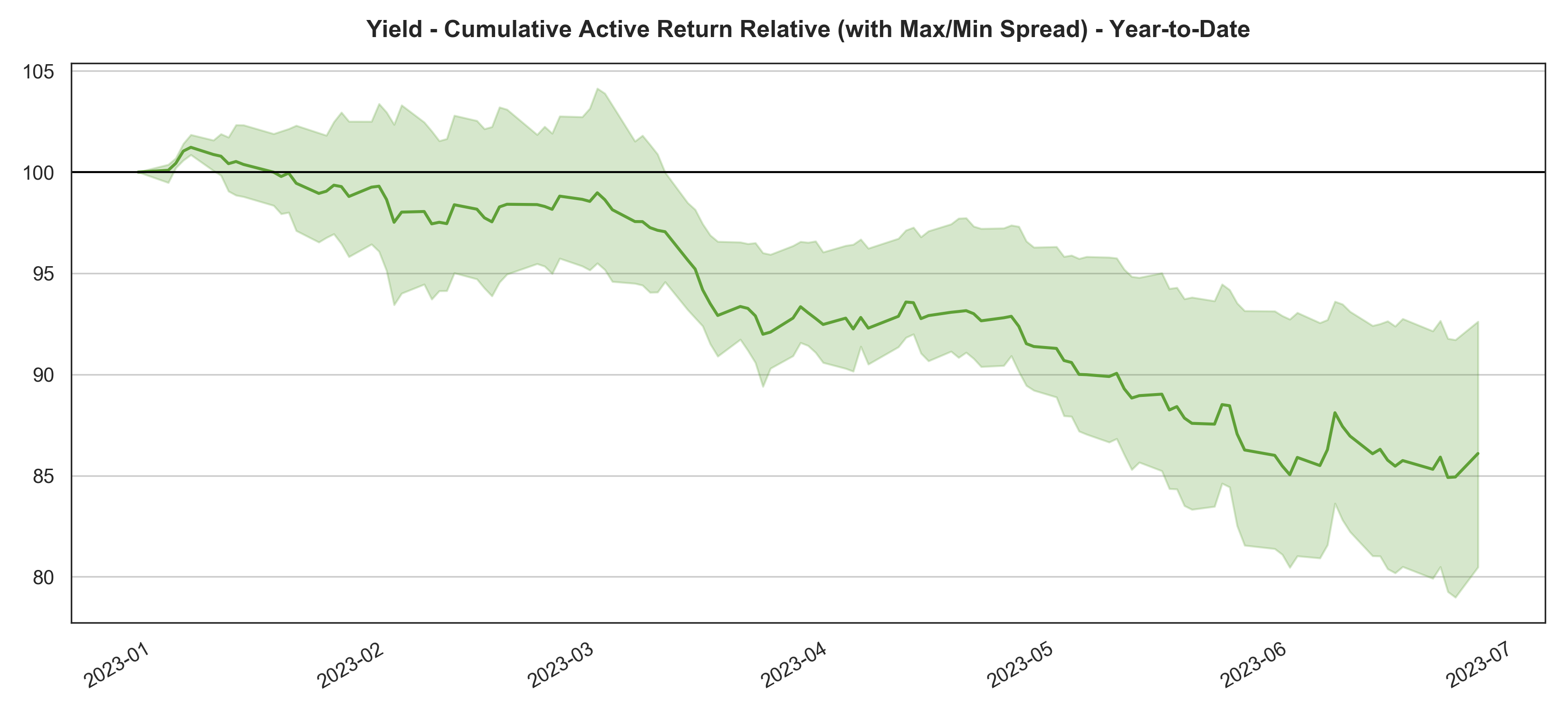

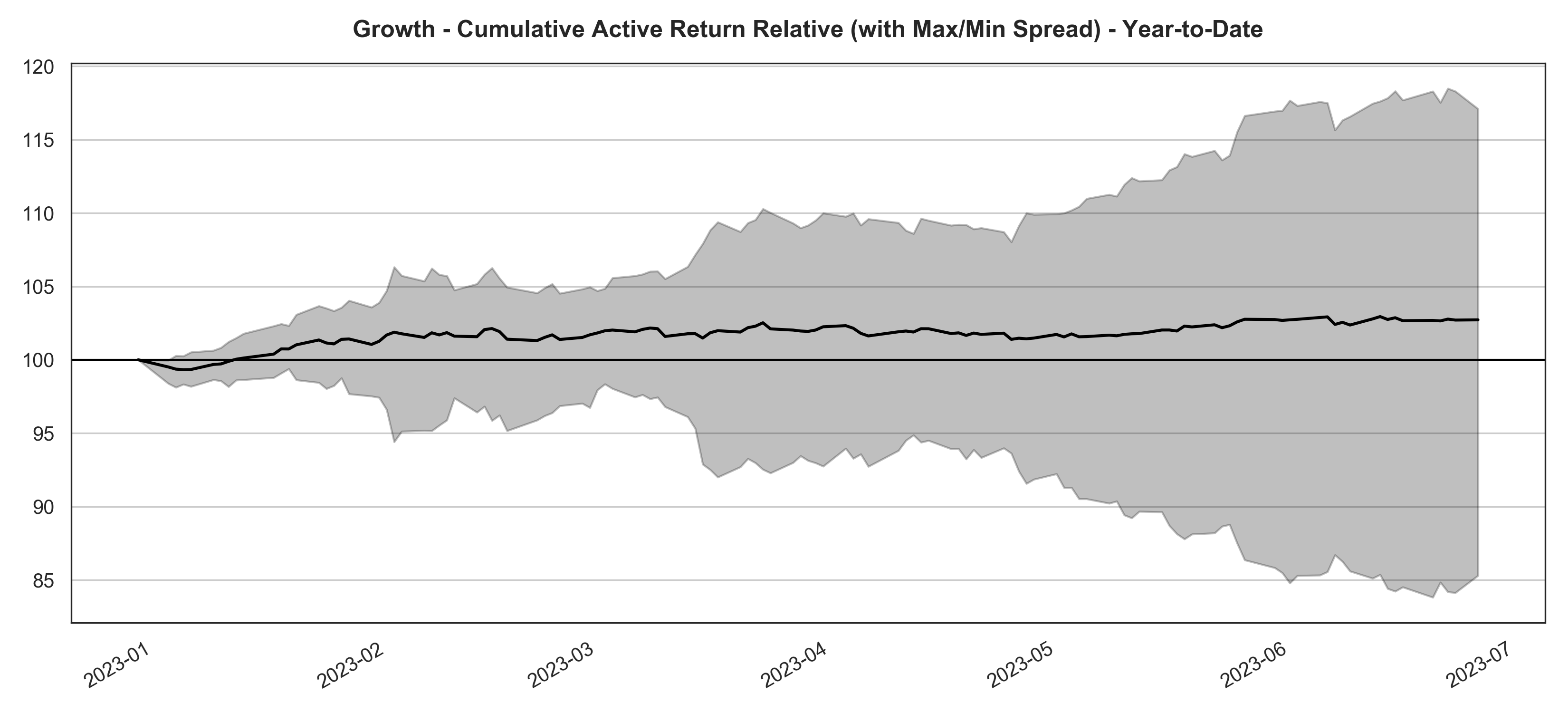

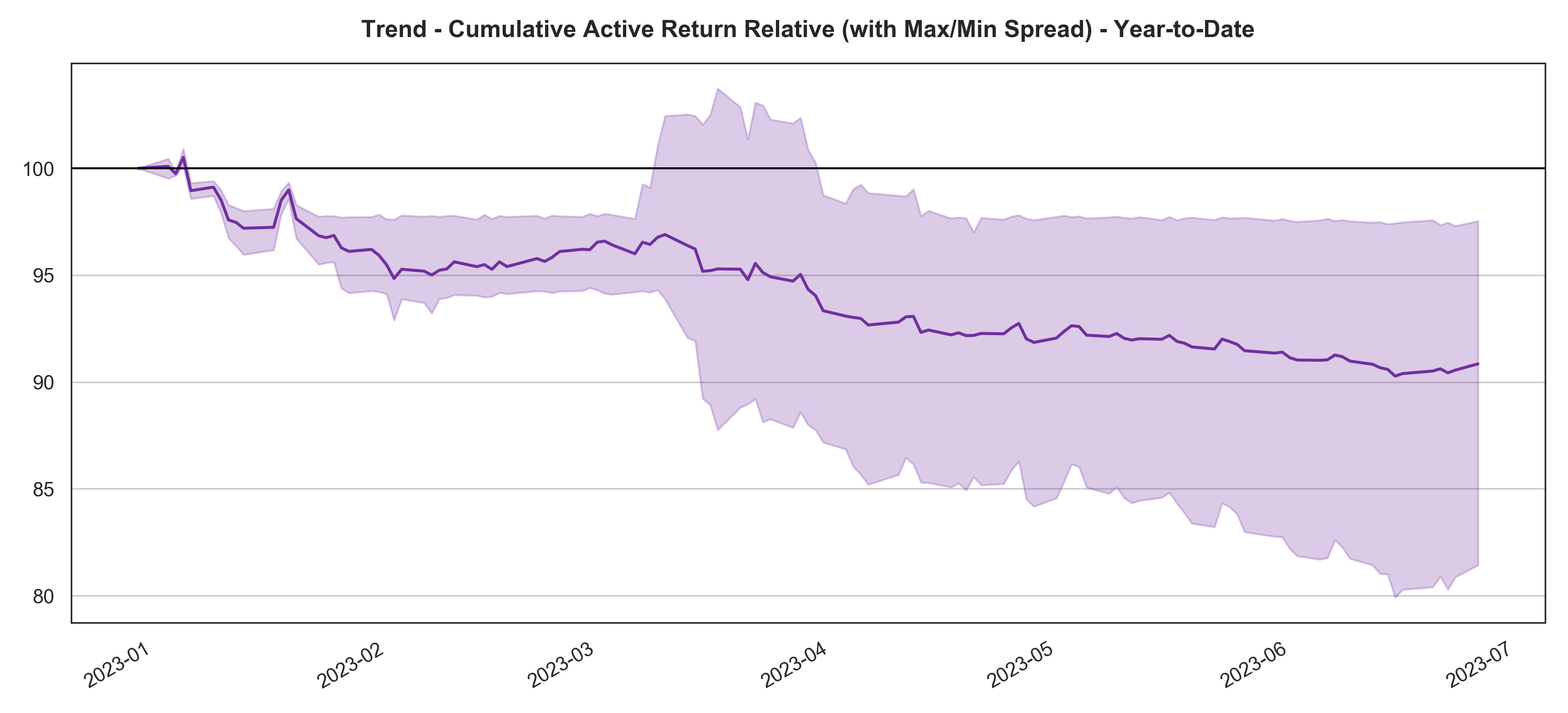

Year-to-Date returns are computed by assuming an equal-weight allocation to representative long-only ETFs for each style. Returns are net of underlying ETF expense ratios. Returns are calculated in excess of the SPDR S&P 500 ETF (“SPY”).

The ETFs used for each style are (in alphabetical order):

- Value: FVAL, IWD, JVAL, QVAL, RPV, VLU, VLUE

- Size: IJR, IWM

- Momentum: FDMO, JMOM, MMTM, MTUM, PDP, QMOM, SPMO

- Low Volatility: FDLO, JMIN, LGLV, SPLV, SPMV, USLB, USMV

- Quality; FQAL, JQUA, QUAL, SPHQ

- Yield: DVY, FDVV, JDIV, SYLD, VYM

- Growth: CACG, IWF, QGRO, RPG, SCHG, SPGP, SPYG

- Trend: FVC, LFEQ, PTLC

Newfound may hold positions in any of the above securities.